Workers' comp claims management for employers

Close claims faster and save money with workers' compensation claims management built into your Kinetic policy—designed for employers who want more visibility, better outcomes, and more control.

BENEFITS

Why choose Kinetic workers’ comp for claims management

Speed, measurable value, and trusted guidance.

Close claims faster

The faster claims close, the less they cost. Kinetic surfaces risk early so employers can intervene before small issues turn into expensive claims.

Save money

Reduce claim costs and long-term premiums through tighter reserves, faster return-to-work, and fewer escalations.

Know what to do next

Clear, guided next steps on every claim, at the moment it matters most, help employers easily follow best practices.

HOW IT WORKS

A better way to manage workers' comp claims

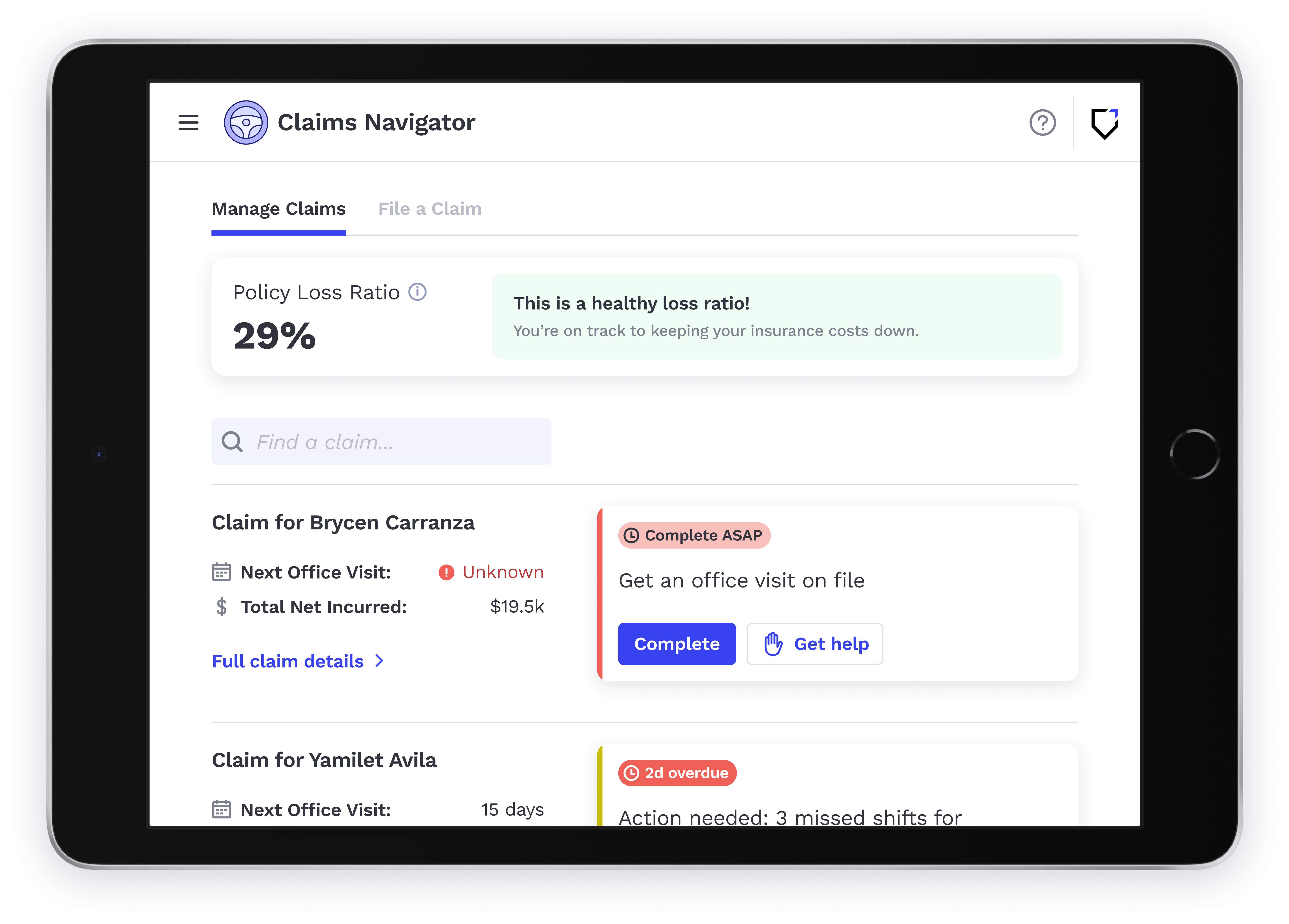

Drive better claim outcomes with AI-driven workflows that guide employers through every claim from the moment of injury to closure.

1. Stop chasing updates

No more hunting through static portals and old emails. Adjuster notes and claims data are pulled in daily, so you always know what's happening.

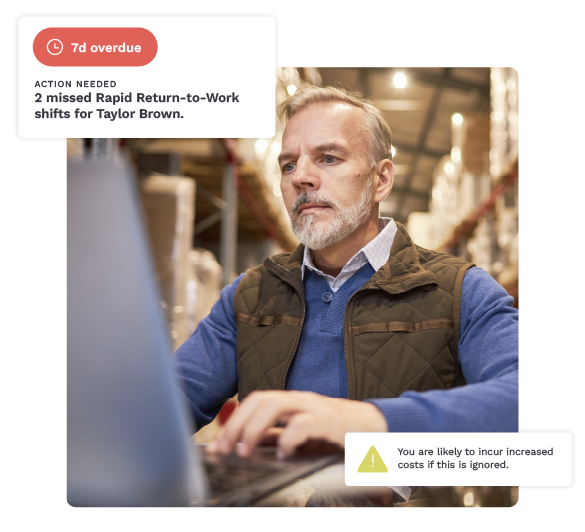

2. Spot risk early

See missed appointments, stalled return-to-work, or drifting claims before costs climb.

3. Act with confidence

Get clear next steps delivered to your inbox, phone, or dashboard so you know where to focus.

.png?width=1201&height=1201&name=How-it-works-3_300x300@4x%20(1).png)

4. See the cost of waiting

Understand how claim delays impact your loss ratio in real time, making the cost of waiting visible.

"There is NO comparison to other work comp providers' claim processing and treatment to us.”

Owner

Parcel Delivery Provider

FEATURES

Built for employers who want better outcomes

See every claim in one clear, continuously updated view.

Follow step-by-step guidance so anyone can manage claims with confidence.

Replace quarterly claims reviews with real-time insight and action.

Understand the cost of doing nothing with live loss ratio visibility.

Get support from Policyholder Success Managers when you need it.

The Kinetic Injury Management Platform

Predict risks, prevent injuries, and manage incidents when they happen. See how you can reduce workplace injuries, lower costs, and help employees get back to work—all in one platform.

Close claims faster, save money

Claims Navigator FAQs

Is Claims Navigator included in my workers' compensation policy?

Yes, Claims Navigator is available for all Kinetic policyholders, at no additional cost. Your program may also include tech-managed Return-to-Work or Reflex safety wearables based on your risk profile.

What is workers' compensation claims management?

Workers' compensation claims management is the process of reporting, tracking, and actively managing a workplace injury from the moment an injury occurs through return to work and claim closure. Effective claims management helps employers close claims faster, control costs, and support injured employees.

When should an employer report a workers' comp claim?

Who's responsible for managing workers' comp claims?

How can employers reduce claims costs?

Claims can become expensive when early warning signs like missed light-duty work, outdated restrictions, or gaps in communication go unnoticed. A claims management system helps employers spot drift early and take the right action at the right time, preventing minor issues from turning into costly medical and indemnity claims.

What role does return-to-work play in claims management?

A structured return-to-work program is one of the most effective ways to reduce claims costs. Bringing injured employees back in modified or transitional roles shortens claims length, supports recovery, and significantly lowers indemnity costs.